Reviews

Reviews

Federal Solar Tax Credit (What It Is & How to Claim It for 2024)

In this EcoWatch guide on the federal solar tax credit (ITC) you’ll learn:

- What are the steps to claim the federal ITC?

- How the IRA affected the federal solar tax credit?

- Plus some tips to make claiming the tax credit a breeze

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Disclaimer: This article is for informational purposes only. It should not be relied on for and is not intended to provide accounting, legal or tax advice.

What is the Federal Solar Tax Credit (ITC)?

The federal solar tax credit is a clean energy credit that you can claim on your federal returns. This tax credit is not valued at a set dollar amount; rather, it’s a percentage of what you spend to install a residential solar photovoltaic (PV) system. The tax credit is currently set at 30% of your total solar panel system installation cost.

Tax credits help to reduce the amount of money you owe in taxes. So, for example, if you claim a tax credit of $4,000, the total amount you owe in income taxes will be reduced by $4,000. It’s important to note that this is not a tax deduction, which reduces your taxable income rather than your total tax liability.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

How Does the Federal Solar Tax Credit Work?

Say your solar project was quoted at $20,000. A 30% credit would save you $6,000 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn. The tax credit does not get applied to your tax refunds.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States. (It does not have to be your primary residence, but you can only claim it once, and you must live in the residents for at least part of the year.)

The system must be placed in service (in other words, it must be “turned on” and generating power) during the tax year. So, if you install and begin using a residential solar system during the year 2022, you’ll claim the credit on your 2022 tax filing. If you start a solar panel installation in December of 2022 but don’t turn the system on until January of 2024, you’ll claim the credit on your 2024 filing.

Recent Updates to the Solar Tax Incentive

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

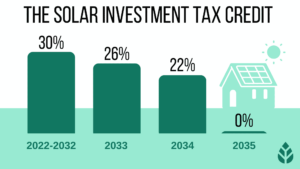

Thanks to the passage of the Inflation Reduction Act in August of 2022, the tax credit was bumped from 26% to 30%. The credit will remain at 30% until Jan. 1 2033 when it will drop down to 26%. In 2034, it will drop to 22% before phasing out in 2035.

Here’s an overview of what is currently planned for the future of the tax credit:

| Year Placed In Service | Federal Solar Tax Credit |

| 2021 | 26% |

| 2022-2032 | 30% |

| 2033 | 26% |

| 2034 | 22% |

As you can probably imagine, the effective savings you could see with the ITC will vary depending on when you install your system, as well as how much your equipment and the installation services cost. The table below includes a breakdown of the typical credit amount you could see based on average solar installation costs throughout the country.

| State | Average ITC Value |

| Alabama | $12,834.00 |

| Alaska | $5,634.00 |

| Arizona | $10,384.50 |

| Arkansas | $10,461.00 |

| California | $5,994.00 |

| Colorado | $7,920.00 |

| Connecticut | $7,852.50 |

| Delaware | $8,721.00 |

| Florida | $10,488.00 |

| Georgia | $10,857.00 |

| Hawaii | $5,593.50 |

| Idaho | $9,780.00 |

| Illinois | $7,740.00 |

| Indiana | $10,431.00 |

| Iowa | $9,909.00 |

| Kansas | $8,640.00 |

| Kentucky | $10,098.00 |

| Louisiana | $12,712.50 |

| Maine | $6,552.00 |

| Maryland | $10,110.00 |

| Massachusetts | $7,254.00 |

| Michigan | $7,602.00 |

| Minnesota | $8,640.00 |

| Mississippi | $11,281.50 |

| Missouri | $9,828.00 |

| Montana | $8,694.00 |

| Nebraska | $11,182.50 |

| Nevada | $9,120.00 |

| New Hampshire | $7,351.50 |

| New Jersey | $7,077.00 |

| New Mexico | $7,245.00 |

| New York | $6,864.00 |

| North Carolina | $10,111.50 |

| North Dakota | $10,362.00 |

| Ohio | $8,613.00 |

| Oklahoma | $11,022.00 |

| Oregon | $9,348.00 |

| Pennsylvania | $8,313.00 |

| Rhode Island | $6,624.00 |

| South Carolina | $10,791.00 |

| South Dakota | $9,796.50 |

| Tennessee | $11,556.00 |

| Texas | $10,971.00 |

| Utah | $7,560.00 |

| Vermont | $6,462.00 |

| Virginia | $11,055.00 |

| Washington | $10,080.00 |

| West Virginia | $11,088.00 |

| Wisconsin | $6,972.00 |

| Wyoming | $8,883.00 |

*Please note that these values are based on average solar panel costs per watt and typical monthly electricity consumption by state.

What Does the Solar Tax Credit Cover?

Taxpayers who installed and began using a solar PV system in 2022 (and those who start using solar in 2022) can claim a federal tax credit that covers 30% of the following costs:

- Cost of solar panels

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries. Storage devices must have a capacity rating of at least 3 kilowatt-hours (kWh).

- Sales taxes paid for eligible solar installation expenses (though some states waive sales tax on PV system equipment)

Are You Eligible to Claim this Federal Solar Incentive?

Your eligibility to claim this federal solar incentive on your and receive your 30% tax credit is based on whether you meet the following criteria :

- Your solar PV system must have been installed and began operating at some point between January 1, 2022, and December 31 of 2032.

- Your system must have been installed at either your primary or secondary residence.

- You must never have claimed the ITC in the past for another property.

- You must reside in the property on which your solar array is installed for at least a portion of the year.

- You must own the solar PV system, whether you paid upfront or are financing the cost. You won’t be eligible if you opt for a solar lease or power purchase agreement (PPA).

- The solar system must have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you won’t be able to claim a second credit.

- You must be a U.S. citizen and taxpayer.

- The property you’re installing solar on must be located in the United States.

5 Steps to Claim the Solar Credit On Your Federal Returns

The solar tax incentive is claimed as part of your annual federal tax return. Any reputable solar company should provide documentation and instructions on exactly how to claim the ITC as part of your solar installation. Below is a quick overview of what that process will look like. Though fairly simple, it’s best to consult with a tax professional when filing your return.

To claim the federal solar tax credit, follow these steps:

- Download IRS Form 5695 as part of your tax return. This residential energy tax credit form can be downloaded straight from the IRS.

- Calculate the credit on Part I of the tax form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

- If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

- On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet (found here). Then, complete calculations on lines 15 and 16.

- Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

As a reminder, the tax credit only offsets the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year.

In addition to the ITC, be sure to file for any sales and property tax exemptions that may be available in your state. Below is a video we’ve included to help you get your tax credit. It’s for the year 2020, but instructions are still good for 2021, 2022, 2023 and 2024.

How Does the Federal Tax Credit Affect Other Solar Incentives?

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other solar incentives may impact your federal tax credit. Here’s what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit. However, the compensation you receive through net metering shouldn’t affect your federal tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credit you get for your residential solar system will not decrease your federal tax credit amount. However, getting a state tax credit means the taxable income you report on your federal returns will be higher, as you’ll have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income but will not reduce your tax credit.

You might also be eligible for other federal incentives related to energy efficiency, although the ITC is the only perk specifically for solar equipment. Additionally, the ITC is currently far and away the most beneficial tax credit available to homeowners for energy efficiency upgrades. Other federal incentives you may qualify for include the following:

- Federal heating and cooling tax credits: You can get up to 30% of your installation cost as a tax credit for different heating and cooling equipment (up to $2,000 for heat pumps, $600 for central AC systems, $600 for boilers, $2,000 for biomass heaters, and $600 for furnaces).

- Federal water heater tax credits: You can get up to 30% of your costs for upgrading your water heater via a tax credit (up to $2,000 for heat pump water heaters or $600 for traditional water heaters).

- Federal tax credits for green building products: You can get a tax credit of up to 30% for installing green building products (up to $1,200 for new insulation, $600 for windows, or $500 for exterior doors).

- Federal electrical panel upgrade tax credit: You can get a tax credit of up to 30% of $600 of your cost to upgrade your electrical service panel).

- Federal home energy audit tax credit: If you get a home energy audit completed, the federal government could provide tax credits of up to $150 or 30% of the total cost.

Additional Resources On The Federal Solar Tax Credit

- IRS Form 5695 To Receive The Tax Credit On Solar Installations

- Are Solar Panels Really Worth The Money?

- Department of Energy’s Guide To Federal Solar Investment Credit

- How Does the Inflation Reduction Act Affect Going Solar? (Rooftop Panels, Heat Pumps & More)

FAQs: Federal Solar Tax Credit

Below are some questions that the EcoWatch team commonly receives about the federal solar tax credit.

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

As part of the Inflation Reduction Act, Congress extended the federal solar tax credit for an additional ten years. Residential solar customers can enjoy a 30% tax credit towards the cost of their installation through the end of 2032. In 2033, it will drop to 26%. In 2034, it will drop to 22%. Starting Jan. 1, 2035, the credit will no longer exist.

You can claim the solar tax credit if you are not a homeowner, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the credit.

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home. That means off-grid solar homes are eligible (including their battery storage units). In most cases, solar RV homes are eligible, too.

Yes, your solar panels do not have to be installed on your roof in order for you to claim the solar tax credit. Ground-mounted solar panels may also be eligible, so long as they are generating solar energy for your home.

Popular Solar Incentives By States

- California Solar Credits & Incentives

- Texas Solar Credits & Incentives

- New Jersey Solar Credits & Incentives

- North Carolina Solar Credits & Incentives

- Arizona Solar Credits & Incentives

- Florida Solar Credits & Incentives

- Maryland Solar Credits & Incentives

- Massachusetts Solar Credits & Incentives

- New Mexico Solar Incentives

- Illinois Solar Credits & Incentives

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k