Are ‘Free Solar Panels’ Really Free? (2024 Guide)

In this EcoWatch guide on ‘free solar panels’, you’ll learn:

- Who pays for the ‘free solar panels’

- How you can get solar panels for no money down

- What some legitimate solar financing options are

This guide has helped thousands of homeowners to avoid getting taken advantage of when going solar and provided them with actual ways to save money. Let’s get started!

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Are ‘Free Solar Panels’ a Scam?

You may have seen advertisements or had someone knock on your door offering free solar panels. But are “free solar panels” really free? Let’s get this out of the way early — “free solar panels” are not really free.

There is no such thing as free solar panels, and there is no such thing as a no-cost solar program. If you’re hearing about “free” or “no-cost solar programs,” you’re likely being fed a cheap sales pitch to tempt you into signing a solar lease, or a power purchase agreement. These solar financing options have some merit, but not when they’re pitched by shady companies as free panel programs.

Under these solar financing agreements, a solar company installs solar panels on your home for no money down (hence, the misleading use of the word “free”), and you then either pay a monthly rate for the clean energy those panels produce, or you pay to rent the panels rather than paying for the energy they generate. Think about it as renting solar panels, or simply buying your power from a solar company instead of a utility company.

Zero-money-down installation, free maintenance, free enrollment, guaranteed savings written into the contract — these promises are all just a little too good to be true. We’ll get into the fine print on why “free solar” is so misleading, but if you’re looking to install solar panels on your home for $0 down, it’s best to do so with loan financing.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

We like Blue Raven Solar because it understands that, for most homeowners, the cost of solar presents the biggest barrier to entry.

For that reason, Blue Raven Solar developed an innovative solar financing plan that offers in-house, flexible, zero-money-down options. The results speak for themselves, as Blue Raven Solar is now one of the fastest-growing solar companies in the nation and was recently acquired by SunPower. Its BluePower Plus+ plan (exclusive to Blue Raven) mimics the flexible structure of a lease while still providing the greatest benefits of owning your system.

Eligible homeowners enjoy 18 months of solar power before having to pay their first bill. When coupled with the federal solar investment tax credit (ITC), the initial energy savings can offset more than a third of the overall cost of a system before requiring a dollar down.

In contrast, other installers can only offer similar financing through solar leases, PPAs or third-party providers (such as Mosaic or Sunlight). Third-party loan providers can complicate the process, while opting for a loan or PPA will disqualify you from some of solar’s biggest benefits (additional property value, federal solar tax credit and local solar incentives).

Facts and Figures: Blue Raven Solar

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 4.5 |

| A+ |

| 2014 |

| $$ |

| Solar Panels, System Monitoring |

| Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower |

| 25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee |

What Are Legitimate Solar Panel Financing Options?

The marketing strategies advertising “free solar panels” are designed to entice, but in many cases, solar leases and PPAs end up being less beneficial options for homeowners. In some severe cases, solar companies have even faced lawsuits over falsely advertising “free solar panels” to unsuspecting customers who lost thousands by signing unfair contracts.

- Lease agreements have hefty cancellation fees, sometimes as high as $20,000.

- If you ever decide to sell your home, transferring a lease to a new homeowner can be challenging. If the new owner doesn’t agree to assume the solar lease, you might have to pay to move the panels to a new residence, or worse, be forced to cancel your lease and pay the cancellation fee.

- In a worst-case scenario, hiring a low-quality solar panel installation company can lead to issues with your home or roof. Solar leases may not offer workmanship warranties, so you could face bills for any damage to the integrity of your home.

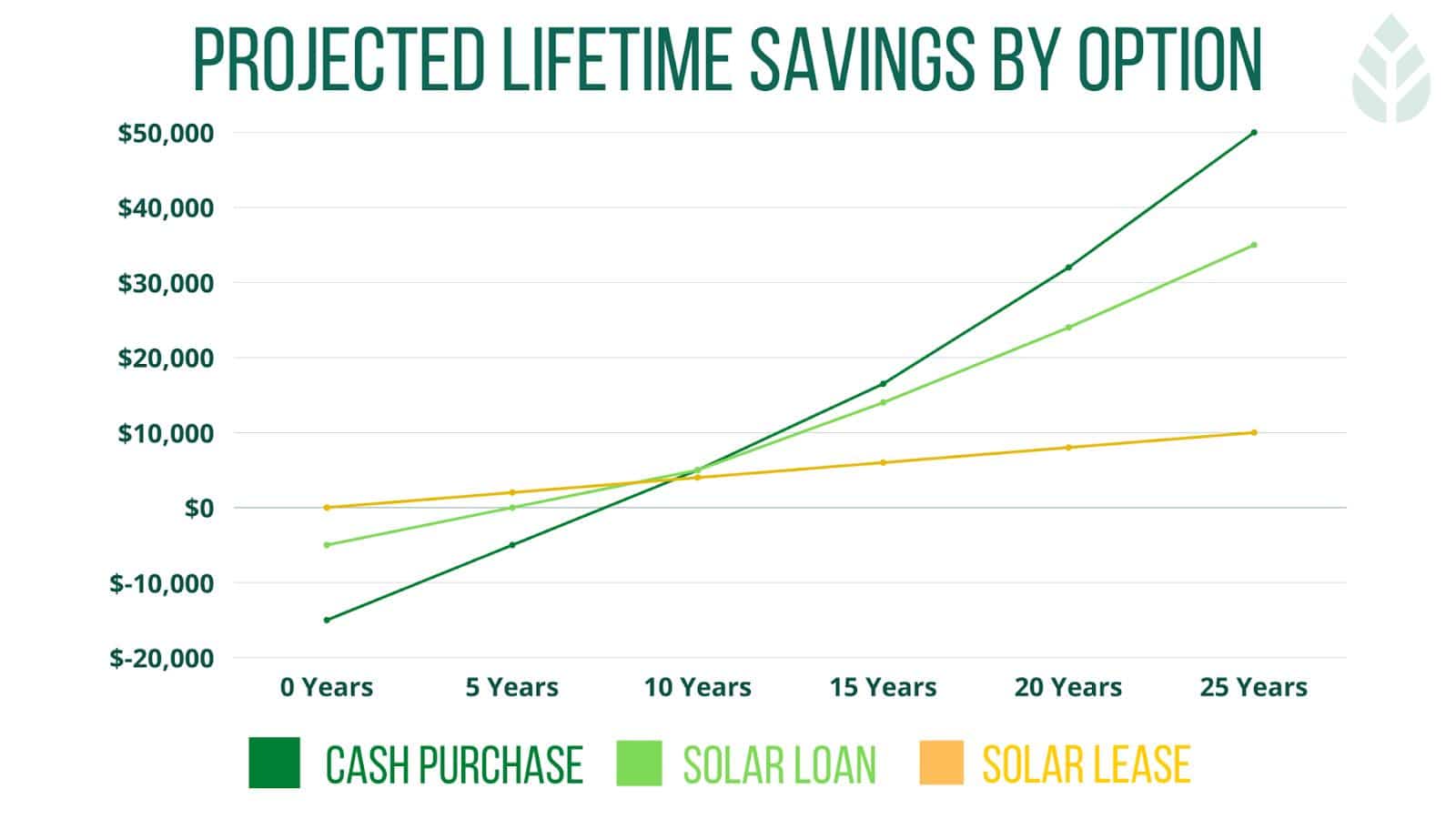

Solar leases and solar PPAs are not themselves scams, but homeowners should be cautious and educate themselves before signing a lease. They are less beneficial in the long run than buying in cash or with a loan. For example, the average U.S. resident that enters into a solar lease or PPA will save between $5,000 and $6,000 on their electric bills over the life of their system. Those savings increase to around $25,000 if you go with a loan, and they sit around $31,513 if you buy your panels in cash.

It’s worth mentioning that the upfront cost of a cash purchase and the down payment and credit requirements needed for a solar loan can make these options less widely available. This is expected to become more of an issue as more states adopt net metering 3.0, which recently took effect in California. System costs will go up as batteries become more of a necessity, which means leases and PPAs might become the norm in the near future.

Again, leases and PPAs aren’t inherently bad; just make sure to read the fine print.

So, if “free solar panels” aren’t really free, what is the best way to pay for solar panels?

1. Paying for Solar Panels in Cash

Paying for solar in cash will yield the most long-term savings. By purchasing a home solar system outright, you’re essentially paying for about 25 years of discounted electricity at once. A cash purchase allows you to calculate home energy costs decades in advance, avoiding interest rates, fees and utility rate hikes.

The average U.S. homeowner that pays for their solar array in cash will save around $31,513, and that’s after the system pays for itself. This takes into account the monthly savings you’ll see on your electric bills, as well as the rising cost of purchasing solar energy from your utility company.

However, it doesn’t account for the cost of batteries. With batteries, you’re looking at long-term savings between $11,513 and $21,513, on average.

2. Solar Financing Through Loans

We understand that spending $15,000 or more upfront just won’t be feasible for all homeowners. Solar loans allow you to borrow money from a lender to purchase your solar system, which you can repay over time with your energy savings.

Typically, solar loans come in the form of unsecured personal loans, home equity loans or lines of credit, and in-house financing options offered directly through a solar installation company. Taking out a solar loan offers a key benefit to borrowers: A low initial payment that doesn’t make you lose out on the benefits of system ownership — mainly the federal solar investment tax credit, used to offset 30% of the total cost of solar.

With a solar loan, you’ll usually pay nothing upfront as a down payment, and your system cost will be the same. However, you’ll pay an average interest rate of between 4% and 8%, and you might be charged an origination fee. Over your loan period, you’re expected to pay between $5,000 and $10,000 in interest, which would reduce your overall savings to an average of between $21,513 and $26,513. With the addition of batteries, you could be looking at total savings of around $11,000.

If you’re ready to start learning about these options from solar installation companies in your area, you can click below to connect with an EcoWatch-vetted installer and get a free estimate.

3. Leasing Solar Panels or Power Purchase Agreement

As we’ve covered, in solar leases or PPAs, a solar company installs a solar panel system on your home; you then pay a monthly rate for the solar power those panels produce. The solar company you lease through will retain ownership of the panels, thereby cashing in on the solar tax credit.

Solar leases and PPAs are close to interchangeable, but for one key difference: In a solar lease, you make fixed monthly payments to use the solar energy system, whereas in a PPA, you purchase the electricity produced by the panels. Leases are more common through national solar companies like Sunrun and SunPower.

With a lease, you should save instantly on your electric bill, although the monthly savings will average between $10 and $50, and eliminating the typical electric bill of $139.06 in the U.S. isn’t possible, especially since you’ll be paying a monthly fee for the panels or the power they produce. Over the lifespan of your agreement, you’ll likely save around $5,000, making it the option that saves the least overall.

Savings are estimated for a medium-sized home with monthly energy costs of $150 per month.

Read More: Solar Panel Financing Advice from the Federal Trade Commission (FTC)

Fact-Checking Free Solar Claims

Let’s take a look at this pitch for “free solar,” which I found when Googling “free solar panels.” See anything fishy?

- “Free Solar.” This language is misleading. At this point, you’ve realized solar leases/PPAs are not “free” at all. The panels won’t belong to you, and though you won’t pay for the installation cost itself, you’ll start making immediate monthly payments to two energy providers: your local utility and your solar company. Let’s hope your system produces as advertised.

- “Dramatically reduced monthly electric bills.” The word choice here may be a bit of a stretch. Though the contract guarantees you’ll pay less than your average monthly utility bill, savings are typically nominal when compared to purchasing a system. If you had a $100 monthly energy bill going into a solar lease, an average customer might reasonably expect to have payments around $75 or $80 per month after installation (if things go to plan).

- “Warrantied, monitored and maintained by your solar provider at no charge.” Let’s start with “warrantied.” Though the panels themselves are covered by warranty, any workmanship errors or issues with your roof or electrical system may be uncovered. Though solar companies do maintain leased panels, it’s worth noting that they do not cover removal or reinstallation costs if you need to make repairs to your roof or temporarily remove the panels for any other reason. Removal and reinstallation costs can reach $2,000 to $4,000 or more depending on the complexity of the home.

- “Home solar has been shown to add $25,000 to the value of your home.” Perhaps the most directly misleading claim on this advertisement, this is true only if you own the system. In a solar lease, the solar company owns the panels on your home. If anything, solar leases can complicate a home sale, as new homeowners don’t always want to assume the remainder of the lease.

Read Also: Homeowners Guide to Financing a Grid-Connected Solar Electric System

How Can I Get Solar Panels With Zero Money Down?

Though we’ve debunked “free solar,” solar leases, PPAs and solar loans all offer a viable way to switch to solar energy for little to no money down. These options are going to become more prevalent in the near future, when the new net metering program takes effect in states outside of California.

If it doesn’t overstretch your budget, solar loans offer the most practical method to own solar panels without any upfront costs, for now, but that could change if NEM gets updated in your state. Remember, system ownership makes you eligible for key financial incentives that decrease your solar payback period and offset the cost of solar, including:

- The federal tax credit (ITC), which is worth 30% of equipment and installation costs in 2022

- Local sales and property tax exemptions

- Solar rebates through the government or utility companies

- Net metering

- Solar renewable energy credits (SRECs) in qualifying states

- Solar increases your property value

Companies like Blue Raven Solar have responded to the popularity of solar leases by offering their own in-house $0-down financing options that still capture the benefits of system ownership. If you’re convinced a lease or PPA is the best option for you, SunPower, Trinity Solar and Freedom Forever are some of our favorite companies offering them.

If you’re not sure which option is right for your home, it may be worth speaking with a professional.

If you’re ready to learn more, you can click below to connect with an EcoWatch-vetted installer and get a free estimate.

FAQs: Are ‘Free Solar Panels’ Really Free?

Below are a few questions EcoWatch readers regularly send in about ‘free solar panels’. If you have anymore, do not hesitate to contact us at contact@ecowatch.com!

In short, no, you can not get solar panels for free. What is possible however, is installing solar with a $0-down financing option, whether through a solar lease, PPA or solar loan.

Solar leases, PPAs and loans all offer viable options of investing in solar without upfront costs. The best financing option for you will vary depending on your budget, credit score and eligibility for local incentives.

No, there is no such thing as a no-cost solar program. These types of programs are really solar leases or power purchase agreements. In these types of agreements, a company installs solar panels on your roof for no money upfront but charges you to use the power they produce each month.

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k